Everyone who calls our office and has a Virginia injury case (nursing home, medical malpractice, car accident, trucking accident etc.) is asked a serious of questions by our staff.

One of these questions is: DO YOU HAVE MEDICAID?

It is not that we discriminate against potential clients who qualify for Medicaid because of disability or income, rather, Medicaid carries with it some very complicated and important legal issues in a lawsuit.

I’ll do my best to explain that which the State Government takes thousands of pages to do in the law, and written legal opinions:

- 1. Medicaid thinks you are rich if you have more than $10,750 in cash

- 2. If you are rich, you no longer get Medicaid

- 3. If you no longer get Medicaid, that which Medicaid was paying for (nursing home, home health, wound care, hospital care etc.) will no longer be covered

- 4. If Medicaid no longer covers these needs, you will need to obtain private insurance and or be liable for lack of payment

- 5. If you lie to Medicaid about your $, they can deny you Medicaid AND take your money

- 6. If you try to be cute and move, rename or hide assets, Medicaid can deny you Medicaid and take your stuff, like house.

Medicaid in this contexts reminds me of a once loving spouse, that when she learns of your infidelity, becomes your worse nightmare. So better not to cheat at all.

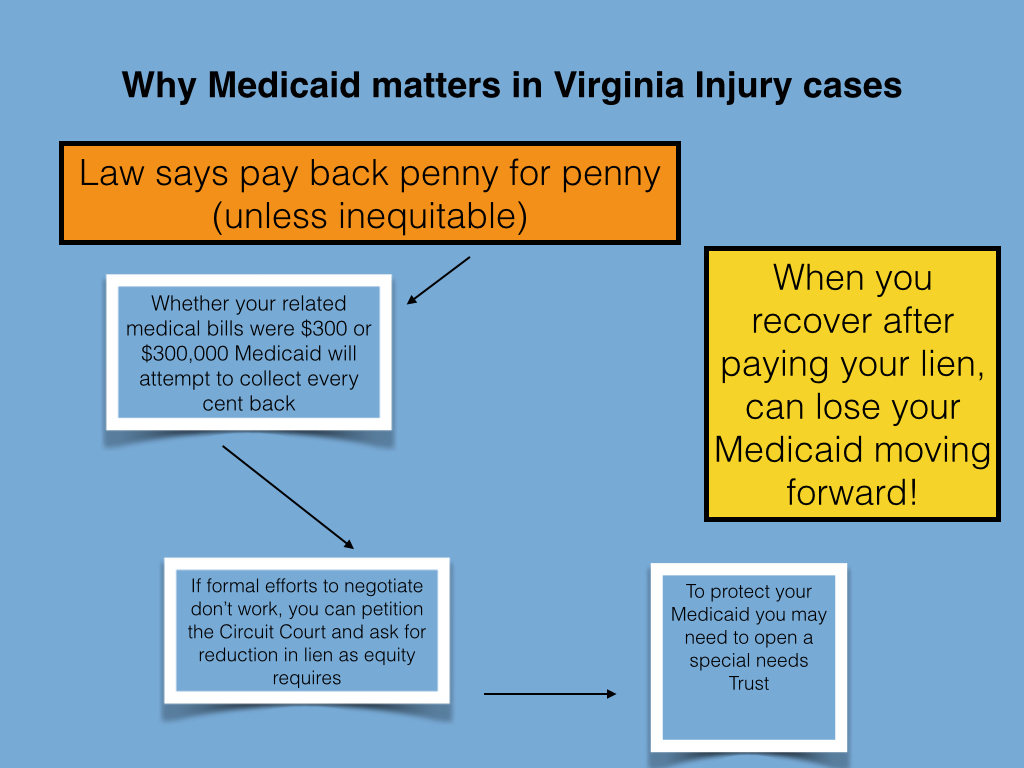

Also, if Medicaid learns you recovered money for an injury, and they paid for related care – they will want, and will take their money back. Penny for Penny.*

Again, see the divorce analogy?

Scenario 1 – Car accident, recovery $100,000, Medicaid paid for 1 night in hospital ($9,000) and visits to physical therapy ($6,5000). After costs of litigation, client has net recovery of:

$100,000 – $33,000 (attorneys fees), – $7,000 (costs) – $15,500 (Medicaid lien) = $43,500. Pretty good deal if the injuries werent permanent. But if the client takes that money, sticks it in the bank, he or she will likely lose their Medicaid benefit and will have to buy private insurance OR place the money in a special needs trust.

Private insurance costs $1500 a month, so the annual cost is now $18,000 a year or so. The lawsuit then provides 2-3 years of insurance premiums and not much else. Worth it? Not likely to the client who lost Medicaid.

OR

Client could place that money in a special needs trust and will need to call the Trustee to spend that $40,000. They won’t lose their MEdicaid (bonus) but they will have some added hoops to jump through.

Neither is ideal. Neither is easy. But either is required.

So when you call a firm to inquire about your potential recovery, and you have Medicaid under Virginia law, ask about the following:

- Do you Lawyer – know about Medicaid liens?

- Do you have experience with protecting client’s Medicaid?

- What is my likely recovery after all liens are paid – is it worth it? And if the firm cannot answer these questions with a YES / YES / YES – don’t pursue the case, at least with them.

The law is tricky sometimes. Call an attorney that knows how to help you navigate medicaid liens and Virginia law.